ADC company Araris Biotech raises CHF15.2m

New ADC company Araris Biotech has got backing by Pureos Bioventures and co-investors in a CHF15.2m seed round to develop a new class of antibody drug conjugates.

·

Besides Pureos Bioventures, London-based 4BIO Capital, btov Partners, Redalpine, VI Partners and Schroder Adveq cofinanced the CHF12.7m addition to seed financing round aimed at bringing the new ADC concept of the ETH Zurich/Paul Scherer Institute spin-off into preclinical and clinical development. Upon the financing, Dominik Escher, Dmitry Kuzmin, Michael Sidler and Arnd Kaltofen joined the company’s board.

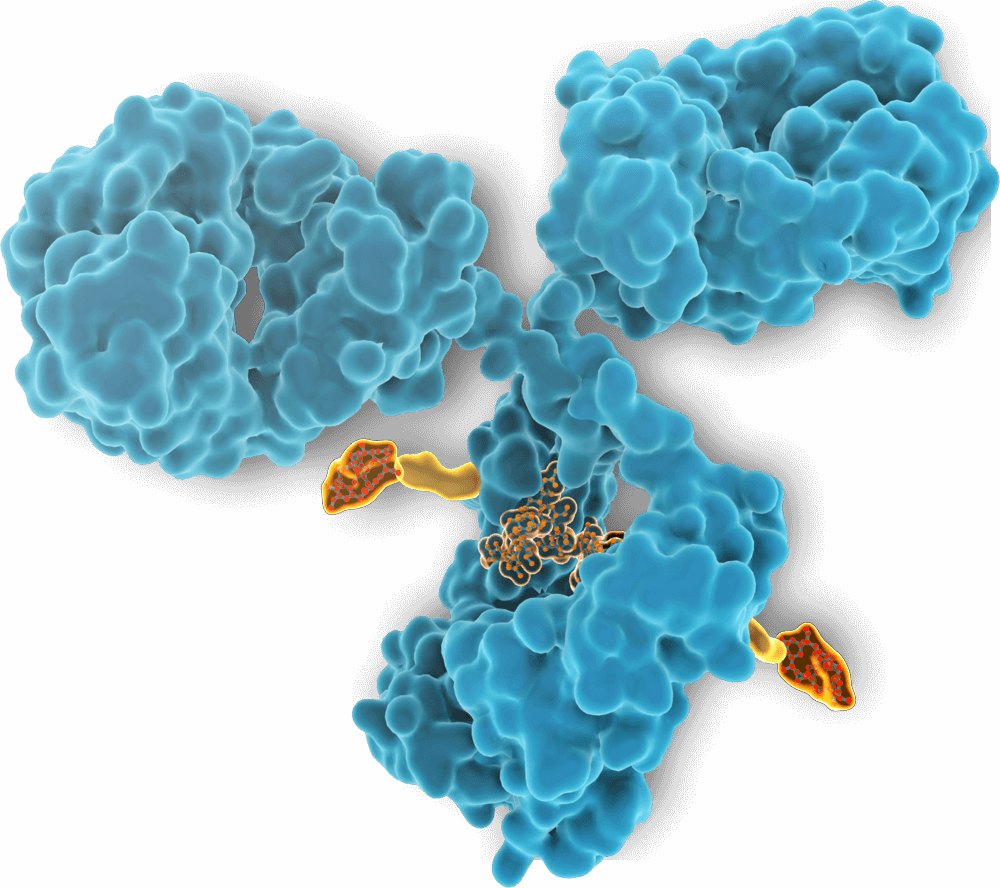

Araris Biotech AG is pioneering a novel antibody-drug conjugate (ADC)-linker technology that allows stochiometric and stable attachment of toxic payloads to ADCs without engineering the native antibody.

The attachment of any payload to off the shelf’ antibodies without the need of prior antibody engineering in one-step offers huge advantages over existing platforms that cannot be dosed appropriately to kill all cancer cells because of toxiticy issues. In contrast, Araris Biotech’s ADCs have a well-defined drug-to-antibody ratio, are stable and monomeric.

According to Dominik Escher, managing partner at lead investor Pureos Boventures "Araris is in an excellent position to advance its antibody-drug conjugates towards the clinic. Today, there are nine antibody-drug conjugates approved by the FDA but many of them cannot be dosed high enough to elicit efficacy due to systemic toxicity often caused by linker instability or heterogenous distributions of the payload. The Araris technology addresses these limitations and offers a novel and innovative approach to bring better therapies to patients in need.

Unsplash+

Unsplash+