A match made in Scandinavia

Two listed Scandinavian biotech companies are about to merge into one. Medical Prognosis Institute A/S (Nasdaq First North Stockholm) in Denmark and Oncology Venture Sweden AB (Aktie Torget) in Sweden aim to create what they call a one-stop-shop for personalised cancer treatments.

By the end of May, the merger had been approved by the shareholders of both companies and by early July, Medical Prognosis Institute A/S (MPI) had sold all of its holdings in Oncology Venture Sweden AB (Oncology Venture) – fulfilling another prerequisite for the merger. According to the project’s timeline, the merger should be finalised in August.

MPI will continue as the legal entity. However, the merged company’s name will be Oncology Venture Scandinavia A/S. The shareholders of Oncology Venture will have a slight majority in the combined company (51.3%) that will continue to be listed on Nasdaq First North Stockholm. Company headquarters will be in Hørsholm, Denmark.

Both parties had already announced their boards’ decisions to accomplish a merger back in March. The two businesses are quite distinct from each other. MPI has a proprietary patient screening technology to predict a patient’s response to drugs; Oncology Venture is a cancer-focused drug developer with six previously discontinued, then in-licensed small molecule drugs.

However, historically speaking, there are tight links between the companies. The first business model for MPI after its foundation in 2004 was to sell biomarkers to biotech and pharma oncology drug developers as a service. However, this strategy proved difficult to build a commercially sound business on as the customers both wanted to pay little and at the same time wanted hold all the IP rights. When I entered the company in 2012 as a CEO it seemed to me like a rational model to use MPI’s drug response predictor (DRP) technology for developing a propriertary cancer drug pipeline and benefit from the full value the DRP can add a drug, Peter Buhl Jensen told EuroBiotech. The result was a spin-off dubbed Oncology Venture. Albeit Oncology Venture managed to build up a pipeline of drug candidates, interested companies shied at signing licensing deals. Partner companies interested in a personalisation of drug candidates, would in some cases be hesitant to enter into negotiations. As the company did not actually own the technology-base used for its drug development, Oncology Venture wasn’t considered a one-stop-shop’, Buhl Jensen added. So the rationale to merge MPI with its spin-off became more and more obvious.

Near-term revenues of the merged company will be generated by the drug development business (out-licensing of Phase III-ready assets). We aim for a deal involving one of Oncology Venture’s promising assets this year, Buhl Jensen told EuroBiotech. In the long run, the service sector is also expected to generate revenues by providing clinical oncologists with a patient screening service to enable them to make more informed choices regarding the selection of optimal drug treatment regimes. Until now there’s no final decision what kind of business model Oncology Venture will go after in this sector.

Operational synergies are expected to amount to a little more than SEK2m (€0.2m) of savings after the successful merger. The direct savings will be reducing the cost of having two listed companies, Buhl Jensen said. However, the most important cost reductions, or rather improved efficiency of resources, will be eliminating the double work related to running the two companies in areas like investor relations, stock exchange listing requirements, and corporate governance needs.

First published in European Biotechnology Magazine Summer edition 2018

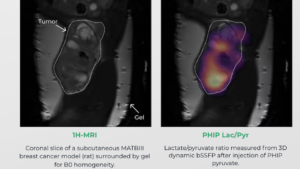

Courtesy Luca Nagel, Department of Nuclear Medicine, Klinikum rechts der Isar, School of Medicine, Technical University of Munich, Munich, Germany

Courtesy Luca Nagel, Department of Nuclear Medicine, Klinikum rechts der Isar, School of Medicine, Technical University of Munich, Munich, Germany Sitryx Therapeutics

Sitryx Therapeutics