Novo Nordisk invests €2.1bn in production expansion

In the race for global market share of its obesity and diabetes blockbuster semaglutide, Novo Nordisk is expanding production in Europe.

While Novo Nordisk’s main competitor Eli Lilly in the emerging market of effective drugs that fight obesity announced an investment of €11bn to scale production of its dual GLI1/GIP agonist tirzepatide in Europe, the Danish company now made public that it is investing €2.1bn to expand its existing production facility for injectables in Chartres, France.

The investment will significantly increase the capacity of the production site by expanding aseptic production and finished product processes as well as the current quality control laboratory. The investment will enable Novo Nordisk to meet future demand for its for GLP-1 agonist semaglutide.

Last week, Eli Lilly announced the expansion of its production in Europe.

In the US, with 70% share in the estimated US$90bn global obesity drug market, Novo was lately not able to satisfy demand for its inkretin agonist semaglutide, who has benn on the market there sind 2021.

The facilities of Novo, which halready had a strong footprint in the European market, will more than double the size of the site in in Chartres. The plant will be designed as a multi-product facility to accommodate current and future processes and provide state-of-the-art technologies and working environments.

The construction projects have now been initiated and will be completed in stages between 2026 and 2028. Eli Lilly announced to start its production in 2027. The investment is expected to create more than 500 new jobs to maintain 24/7 production when construction is complete and the facilities are finalised. Up to 2,000 external employees will be employed during the construction phase.

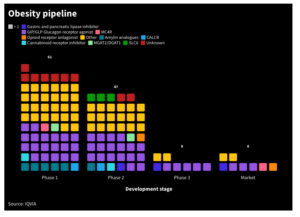

There are currently ten companies that clinically develop inkretins for wight reduction with Novo Nordisk and Eli Lilly are said both having a market share of 45%. While Novo’s semaglutide originally is a diabetes drug, Eli Lilly’s tirzepatid is a second generation product also used in diabetes. Other competitors such as Pfizer, Sanofi or AstraZeneca are developing triple inkretins that block appetite and have been shown to reduce weight up to 20 kg within 40 weeks in people with a BMI over 30.

Currently, Novo and Eli Lilly, who are the first companies that have drugs that are approved in the US and Europe in its portfolio seek label expansion in patients with BMI over 27 with co-morbidities such as heart problems. With an absolute reduction of events in 1.5 of 100 patients, data do not look very convincing, according to clinical experts such as Eric Topol.

IQVIA

IQVIA