UCB is adding a new kind of immune-cell weapon to its immunology arsenal. The Belgian biopharma said it has struck a global licensing deal with Hong Kong–based Antengene for ATG-201, a CD19/CD3 bispecific T-cell engager (TCE) designed to deplete B cells; an approach that has long been validated in autoimmune disease, but is now being re-engineered with next-generation biologics that promise deeper, more durable effects.

ADVERTISEMENT

French biotech OSE Immunotherapeutics is narrowing its ambitions to just two late-stage programs after a one–two hit: AbbVie backing away from an inflammation partnership and Boehringer Ingelheim halting the liver-disease leg of a separate collaboration following a mid-stage failure. The company now says it will concentrate resources on its cancer vaccine Tedopi and its IL-7 receptor antibody lusvertikimab, while pausing or ending several earlier-stage efforts to conserve cash and push toward near-term clinical catalysts.

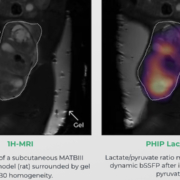

Quantum computers? While most people have heard that their massively parallel data processing could open up an entirely new dimension of information technology, tangible real-world examples remain scarce. NVision Imaging Technologies in Ulm has been active in the field for years and has now developed a visible and practical innovation in metabolic imaging: real-time MRI. Leading academic institutions have already expressed strong interest.

Oxford-based immunology specialist Sitryx has entered into a new agreement with Boehringer Ingelheim aimed at advancing a novel small-molecule programme in autoimmune and inflammatory disease. The deal could be worth USD500 million in total, but the breakdown of the payments in upfront and milestones was not disclosed in detail.

Takeover in Wuppertal: Aicuris Anti-Infective Cures AG, which specializes in active ingredients for infectious diseases, is being acquired by Japanese pharmaceutical company Asahi Kasei for almost €800 million (around US$920 million). The company, founded by former Bayer employees Helga Rübsamen-Schaeff and Holger Zimmermann using substances from Bayer, had obtained its own approval and is currently in late-stage clinical development with active ingredients that are currently being presented with positive data at scientific conferences.

argenx delivered two significant updates on the same day: positive Phase 3 results in ocular myasthenia gravis (oMG) and its first full year of operating profitability. Together, the announcements show a company expanding its lead medicine into a new patient population while doing so from a position of financial strength.

Denmark’s Novo Nordisk has signed a collaboration with Boston-based Vivtex Corporation to develop next-generation oral biologic medicines for obesity, diabetes and associated metabolic diseases. Vivtex is eligible to receive upfront payments, research funding and milestone payments totalling up to $2.1 billion (approximately €1.78bn), as well as tiered royalties on net sales of any resulting products.

GSK will pay $950m for Montreal-based 35Pharma to secure HS235, an investigational activin signalling inhibitor that has completed Phase I trials in healthy volunteers and is set to begin studies in pulmonary arterial hypertension (PAH) and pulmonary hypertension due to heart failure with preserved ejection fraction (PH-HFpEF).

As a co-investor in the USD 25 million Series B round, Beiersdorf AG is signalling that artificial intelligence is becoming strategically important for skin research. The Hamburg-based group is participating through its venture unit in the AI biotech Turbine, founded in Budapest and now also headquartered in London.

Oxford-based Brainomix has added £4.8 million (approximately $6.5m/€5.5m) to its Series C financing, bringing the total round to £18.8 million ($25.4m/€21.5m) and providing fresh capital to accelerate the US rollout of its AI-powered imaging platforms for stroke and lung fibrosis.

Courtesy Luca Nagel, Department of Nuclear Medicine, Klinikum rechts der Isar, School of Medicine, Technical University of Munich, Munich, Germany

Courtesy Luca Nagel, Department of Nuclear Medicine, Klinikum rechts der Isar, School of Medicine, Technical University of Munich, Munich, Germany Sitryx Therapeutics

Sitryx Therapeutics

Beiersdorf

Beiersdorf Brainomix

Brainomix