Increased Demand on HPAPIs Brings Renewed Focus on Product Development and Regulatory Requirements

The rapid growth of active pharmaceutical ingredients (APIs) has led to more biotech companies enlisting the support of strategic partners to navigate the regulatory environment and bring their innovative products to market.

The global high potency active pharmaceutical ingredients (HPAPI) market is expected to reach $38.84 billion by 2028. The explosive development of the HPAPI market is being driven by an increased focus on targeted therapies and a surge in demand for cancer therapies.1 Many small to mid-sized start-up companies, with limited to no Good Manufacturing Process (GMP) knowledge, are inventing a significant proportion of HPAPIs and submitting higher numbers of drug products for regulatory approval with accelerated timelines.

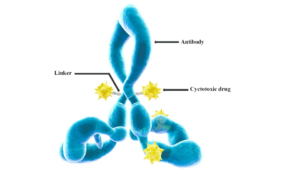

The growing number of biotech companies using HPAPIs represents a new way to provide innovative solutions to patients, often incorporating more precise delivery mechanisms. Currently, 30 percent of the drug development pipeline consists of HPAPIs and this shift towards the increased use of them has led to the emergence of more effective medicines, with potentially lower dose requirements and fewer side effects. HPAPIs are efficacious at extremely low concentrations, but however, their high potency means they can cause harm if not handled properly.

Therefore, these companies are likely to rely on outsourcing partners to manufacture their drug substances, formulate the HPAPIs into dosage forms, guide them through the regulatory process and help them ensure toxic substances are being handled in a safe way. While some might select different CMOs and experts for each step on the route to market, many are learning that choosing an experienced CDMO to manage the HPAPIs and product development simplifies a complex process and shortens the time to market.

Evaluating the constructs of a comprehensive drug development program

A successful drug development program results in product marketing authorization for a drug product in the shortest possible time. Creating such a program to receive final authorization requires careful consideration of several factors including: quality aspects of drug substances; a process designed to fulfill specific criteria in terms of safety, environmental and legal aspects; supply chain integrity; economic requirements; robust manufacturing process control; demand appropriate throughput; diligent monitoring of all components that influence the drug product’s efficacy and safety. In short, the regulatory authorities need reassurance that sufficient manufacturing process knowledge has been established and appropriate process controls have been implemented to consistently manufacture the drug in the required quality in a safe and compliant manner, prior to the drug being commercialized.

Having all the pertinent information on hand early in the clinical development phase will make the entire process run more smoothly. For highly potent products, some aspects require attention well before starting handling material activities. In addition to wanting to know how the occupational exposure limits (OELs) were established, other more practical details are important. Typical questions to be asked and resolved include:

- How and when do you design processes and unit operations to minimize high potency property impact on equipment cost and efficiency?

- How do you design and test equipment, containment and procedures to enable operating at a targeted OEL level?

- How can you ensure that change over operations (e.g. filter exchanges and process changeovers) are designed and operated consistently in a safe manner?

- How do you ensure reasonable ergonomic setup for operations to execute processes and tasks efficiently and safely?

- How can you ensure that any HPAPI, is prevented from dislocating to uncontrolled areas of the manufacturing areas? Is segregation or dedication of assets necessary?

These are some of the aspects that will need to be critically assessed. They must have associated measures and processes defined and implemented with a consistent strategy, which enables robust compliant and efficient handling of highly potent compounds throughout the lifecycle of products.

Health authority requirements and customer expectations

Potential different national requirements as well as different interpretations of regulatory requirements add another layer of complexity to the product development and approval process. The input and insight of an experienced CMO or CDMO is invaluable in successfully navigating the differences. While the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) application and inspection expectations are aligned based on the international harmonization guidelines, they may not always be fully identical. Furthermore, there may even be different expectations from regulatory bodies of other countries which are outside of the harmonization initiative.

An example of where the application requirements may differ is the strategy for accepting the applicant’s proposal for the definition of starting materials and the required application of the GMP and process controls in the subsequent manufacturing steps. As far as highly potent substances are concerned, in practice, the differences are minimal. However, other than regulatory authorities, different customers may have very different expectations and strategies for such compounds, requiring dedicated or segregated assets.

It is rare for manufacturing equipment to be dedicated to a single product. Almost all capacity at larger scale is multipurpose given the high investment cost to realize appropriate control and technical containment measures. Regulators will want to understand how cleaning limits have been calculated and validated for a specific compound. They may want to speak with in-house toxicologists during inspections to make sure the drug properties assessment yielding those limits are appropriate, and the acceptable levels of daily exposure are safe.

Inspectors might also apply different understandings and definitions as to cytotoxic and cytostatic compounds and prompt a need to segregate manufacturing. The questions from inspectors from different authorities, may be different because of local interpretation and application of guidance, which the CDMO needs to be prepared to respond to.

Regulators will also expect certain substances, notably allergenic materials, to be manufactured in a dedicated manufacturing plant. For most other product categories there are not such segregation guidelines. They will also require proof that all necessary steps have been taken to ensure operator safety, and they will want to understand the strategy and measures being used to prevent cross-contamination, something that is especially important for a HPAPI because of the low doses required to cause a clinical effect.

Strategy enabling compliant handling of highly potent compounds

Creating a process design to minimize open handling of high potent material in the process has to occur early in development and clinical phase supply. This may be difficult to achieve for the first-generation process of innovative medicine as time and resources are limited in early clinical phases. This makes strong procedures and state of the art assets handling highly potent products the only viable strategy to handle these compounds.

Wherever a highly potent compound is being handled, a very strong cross-contamination prevention program must be implemented. This should include proven analytical methodologies, strong risk assessment, and a significant application of verification testing throughout plant design and actual manufacturing execution. All of this should be backed up with a clear toxicological explanation of the compound’s properties and strong risk assessment to ensure proper application of the company’s containment strategy to be compliant with the established daily exposure level of product and intermediates. As additional material property knowledge is acquired throughout the clinical stages of development, the toxicological assessment for the compound might change.

Analytical methodology development ideally must comply with late phase requirements at the beginning of clinical phase 3, at least before process characterization has to be performed as a prerequisite to enable process validation for commercial supply. To move from clinical stage production to commercial stage, everything must be in place, from process control in the plant, cleaning protocols and analytical methods, appropriately equipped assets and defined procedures, and finally a full characterization of the process.

Requirements for process and analytical methodology change as the product moves through the preclinical and clinical stages. The CDMO should be able to guide its clients through the validation and documentation demands of the regulators, and ensure they are adhered to.

Using process characterization to secure product development and go-to-market approval

Process characterization-providing objective evidence that potentially critical process parameters are consistently capable of meeting the desired release specifications and process consistency-takes time. Being able to fully utilize the process knowledge collected during the early clinical manufacturing campaigns and building all subsequent development programs on this knowledge is highly beneficial. Thus, detailed documentation of all data, conclusions and development plan throughout the clinical phases is critical to transfer the knowhow within a company or transfer between companies when moving along the product life cycle.

Process characterization work should start as soon as possible. With complex and multiple synthetic process steps, process characterization may take as long as a year, depending on availability and establishment of clinical development data. The process development strategy throughout the clinical phases should also be supported by a global supply chain and good supplier qualification procedures. It is important to get the raw material suppliers qualified early to meet timelines and enable latter use in non GMP or GMP steps for early or late clinical phase supply, with a staggered approach for the requirements on the suppliers moving from early to late clinical phase and finally to commercial product stage.

From a safety perspective, regardless of whether the project is in clinical Phase 1 or commercial, the right safeguards have to be in place for the operation to ensure it is safe at the manufactured scale and allows safe execution of all necessary unit operations. A highly potent compound will require a robust risk assessment based on an established containment strategy. As a company, it may be safer to be more conservative in regard to the OEL assessment until all the required safety data are established, with both primary and secondary containment strategies based on the OEL and the amount of material and its properties being handled.

A comprehensive strategy and complete set of information will help ensure success

Requests for additional information from the regulators will slow the entire process down, and therefore providing a comprehensive, accurate process and product documentation package throughout the clinical phase development is important to meet communicated timelines for market authorization. With small companies often reliant on milestone payments for their products, this is particularly important. A single supplier will allow all of the activities to take place within the same harmonized quality system and will have less challenges to maintain and transfer the established process knowledge over the whole product life cycle. For a HPAPI, meeting the stringent requirements of this product category regarding aspects such as material properties, safe handling and robust containment will be particularly challenging. Such projects thus require suppliers with strong compliance procedures and state of the art assets with appropriate containment design. Ideally, they can support small, medium, and large customers for their product(s) throughout the whole clinical life cycle. Airtight procedures will help provide a consistent and robust product and process knowledge documentation with appropriate advice and/or guidance to the customer pending their needs enabling the best product development possible.

Summary

Overall, there are several regulatory challenges biotech companies face during the manufacturing process, and access to resources and facilities will help bring their innovative drug products to market. To address these challenges and meet the growing demand of HPAPIs, CDMOs are building flexible, integrated capabilities to safely manufacture these drug products given their high potency. In addition, CDMOs may need to tailor their services and have balance to manufacture HPAPIs alongside non-potent molecules. This includes programs from preclinical to commercial production with an emphasis on safe procedures from equipment start-up to handling, cleaning and decontamination, and they come as outsourcing of HPAPI production is increasing at a rapid pace. The expertise and knowledge from these strategic partners are important factors to consider when developing a drug, especially one that is HPAPI-based, as it will help reduce risk and shorten timelines.

1 High Potency Active Pharmaceutical Ingredients Market Worth $38.84 Billion By 2028, Grand View Research, Inc., September 2021.

Vetter Pharma

Vetter Pharma International Journal of Molecular Sciences, doi: 10.3390/ijms17040561 JO - s

International Journal of Molecular Sciences, doi: 10.3390/ijms17040561 JO - s