Switzerland shows sustained growth of biotech sector

The Swiss Biotech sector has again attracted record-breaking investments in 2021, according to the Swiss Biotech Report that was presented at the Swiss Biotech Day 2022 in Basel.

Capital investments in Swiss biotech companies reached the second-best amount ever with CHF3.33bn in the second year of the pandemic, according to the Swiss Biotech Report that was presented by EY on occasion of the overbooked Swiss Biotech Day to estimated 1000+ visitors in Basel. The amount of invested money was at similar level as last year’s record investments that in 2020 had not yet reflect the effects of the COVID-19 pandemic on the sector. Futhermore, R&D investments during the pandemic grew to a record-high if CHF2.56bn, according to the Swiss Biotech Report launched by the Swiss Biotech Association (SBA) in conjunction with EY and seven further partner organisations

During 2021, Switzerland’s life sciences sector again played a major role in combating the COVID-19 pandemic with two Swiss based companies contributing to effective SARS-CoV-2-specific therapeutics (Humabs BioMed/Vir Biotechnology and Molecular Partners/Novartis). However, of the CHF2.56bn that fueled R&D, the vast majority was directed to non-pandemic indications such as immune-oncology, neurology or treatments that modulate the human microbiome or cell-based regeneration. Investors also supported data-driven business models to enable the development of digital therapeutics or a more personalised medicine. The successful IPO of SOPHiA Genetics and the recent MDR certification for the Floodlight Application for multiple sclerosis patients from Roche are successful examples of such data-driven approaches.

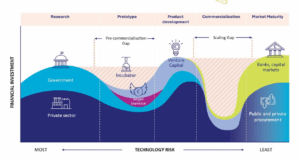

COVID has also focused the attention on the life science sector’s role as an innovator and this year’s report examines in depth the «Sources of Swiss innovation», which have enabled the country to maintain its position at the head of the Global Innovation Index for over a decade. These include the growing number of successful Public-Private Partnerships (PPPs) nationwide, such as IOB in Basel for ophthalmology; the Balgrist Campus in Zurich for musculoskeletal health; the Wyss Centers in Zu?rich and Geneva and the Debiopharm program IDEAL.

«Last year, we expressed some caution that the COVID pandemic might take its toll and that the Swiss inclination not to intervene in the free market, and to avoid providing direct government support for venture-based startups and small/mid-sized R&D companies, could backfire and weaken the innovative power of Switzerland,said Michael Altorfer, CEO of the SBA. "However, record levels of financing in 2020 and 2021 suggest that not only Swiss, but global biotech investors continue to recognize the attractiveness of investment opportunities on offer."

Acording to Frederik Schmachtenberg, EY Partner, Global Life Sciences Lead for Financial Accounting Advisory Services, in 2021, Swissmedic, the Swiss agency for therapeutic products, approved 45 new drugs (2020: 42)

From the invested money in 2021, CHF2.51bn went to public companies, including SOPHiA Genetics with CHF234m (IPO & follow on), Bachem (CHF584m), Idorsia (CHF 600m), CRISPR Therapeutics (CHF229m) and Polypeptide (CHF191m). The largest portion of the private capital (CHF817m) was raised by Anaveon (CHF110m) and Numab Therapeutics (CHF100m).

Overall, the Swiss biotech sector generated revenues of CHF6.7bn, compared to CHF4.9bn in 2020. Growth was mainly driven by an increase in product sales, favourable one-time events from collaboration and licensing deals, as well as a general positive advancement of the product pipeline.

Several Swiss biotech companies were acquired in 2021: Mestex was purchased by Gru?nenthal Pharma; Novartis acquired Cellerys and Inositec was taken over by Vifor Pharma, which itself was later acquired by CSL Behring. In the area of collaborations and licensing arrangements, many successful new partnerships were established in 2021, with the most prominent producing Moderna’s COVID-19 mRNA vaccine at Lonza’s production hub in Visp.

EC

EC Norwegian Mycelium AS

Norwegian Mycelium AS Vetter Pharma International GmbH

Vetter Pharma International GmbH