Hookipa Pharma files for US-$86m IPO

US-Austrian arenavirus-based cancer and infectious diseases specialist Hookipa has has filed a prospectus for an US$86M Nasdaq IPO.

The IPO is underwritten Merrill Lynch, SVP Leerink, RBC Capital Markets and Kempen. In February, Hoopika, which is supported by Baker Brothers, Sofinnova Partners and Forbion Capital Partners as major shareholders, as well as Boehringer Ingelheim Venture Fund, Takeda Ventures, HBM Partners and Redmile Group, the company announced a US$37.4m (€33m) series D fianancing round.

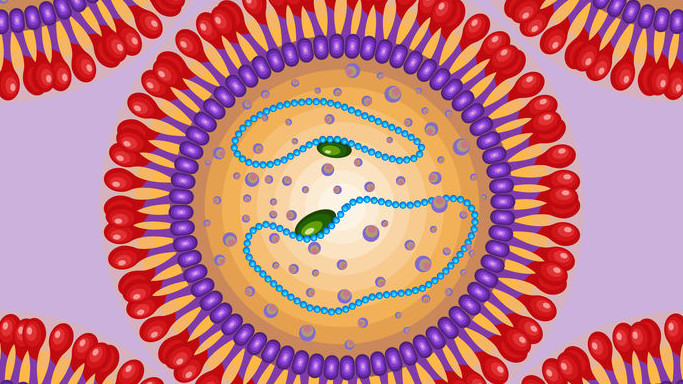

The company applies its arena-virus based vaccination platforms, VaxWave and TheraT, to supercharge the immune system in two therapeutic areas. Hoopika claims that its technologies can leverage the human immune system for prophylactic and therapeutic purposes by eliciting killer T cell response levels not achieved by other published immunotherapy approaches.

In infectious diseases, its Phase II candidate HB-101 aims to prevent activation of dormant infections of the cytomegalie virus (CMV) in CMV-negative organ transplant recipients receiving a CMV-positive transplant. The VaxWave vaccine expresses two CMV antigen fragments, pp65 and CMV glycoprotein B, to induce an immune response. The programme is partnered with Gilead Sciences, which also collaborates with Hoopika Pharma, the US-arm of Viennese Hoopika Biotech, to treat infections with hepatitis B and HIV.

In oncology, Hoopika has two TheraT-based product candidates expressing the highly antigenic E6/E7 fusion protein against HPV-positive cancers under development: HB-201 and HB-202 are set to enter clincical testing this year.

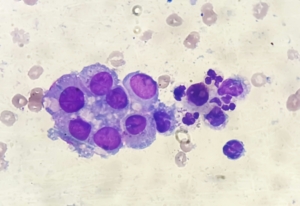

Engineered arenaviruses deliver virus-specific or tumor-specific genes to dendritic cells, which are natural activators of killer T cells.

Unsplash+

Unsplash+