Vertical integration: time is money

Financial pressure on Big Pharma and biotechs increases the need for drug developers to outsource their development and manufacturing capabilities. The CDMO and CRO sector, which is further consolidating through M&A, looks well set for continued growth. As developers have to balance the need to reduce their development risk with time to market or - for biotechs - time to next financing, contract manufacturing and contract research companies clearly favour offering fully integrated services.

The best example to illustrate Big Pharma’s risk aversion, even in possibly highly lucrative future markets, is Sanofi’s recent outsourcing of its anti-infectives R&D to drug discovery service firm Evotec: Under the licence option deal, the French pharma major transfered more than 10 early-stage antimicrobial development programmes, plus its anti-infectives research unit in Lyon to Evotec while retaining option rights for development and commercialisation. The highly profitable CRO received €60m upfront plus long-term R&D funding and sales royalties for development of the assets. Evotec’s CDO Enno Spillner told European Biotechnology that Evotec sees big expansion potential in the €130bn drug development R&D market, in which drug developers currently outsource just 10%-30% of their early and preclinical work, but about 40% of clinical development.

Find the right expert

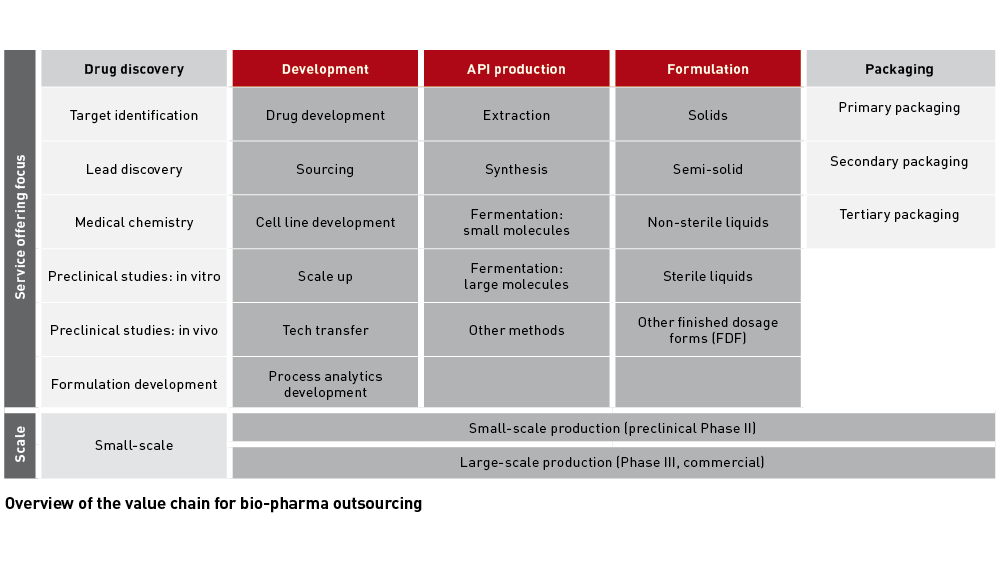

In the fragmented US$62bn+ CDMO market, the ten largest players currently control less than 30% of the revenues, according to a EY report published last September. As the CDMO industry’s annual growth rate of 6% to 7% is slightly outpacing the growth of the pharmaceutical sector (5% to 6% CAGR), the consultancy sees a lot of space for outsourcing and consolidation. EY point to 2017 mergers, such as the US$7.2bn deal of Patheon/ThermoFisher or the US$5.5bn acquisition of Capsugel by Lonza, both aimed at creating full-service providers.

As manufacturing of new drug formats such as fusion proteins, gene or cell therapies such as CAR-Ts, modified or multispecific antibodies is becoming highly complex, specialised CDMOs are predestined to become preferred future targets for the handful of integrated providers. Medium-sized biologics CDMOs have also made significant investments to become one-stop-shops.

With the establishment of FDA Breakthrough and EMA PRIME status, speed from clinic to market has become even more significant in the commercialisation of biopharmaceuticals. For biotechs, the speed at which a CDMO can achieve milestones is crucial because short development times allow them to achieve next-stage funding.

In a way this market pressure is compensated by growing demands for more capacity: scale of production is expected to expand due to longer life expectancy, even in emerging parts of the world, and expansion of drug development markets beyond the US and the EU.

Niche for CAR-T cell- and gene therapy specialists

Currently, one of the most targeted fields of expertise is the lucrative field of cancer immunotherapies and gene therapies, with annual cost of treatments of up to US$400,000 per patient. In the highly lucrative field of cancer immune therapies with genetically engineered T-cell receptors (i.e. CAR-T cells), the complex and costly process of production of autologous CAR-T cells is a major roadblock, according to MediGene’s CFO Thomas Taapken. Everyone in the market thus tries to find ways to reduce cost by trying to establish allogeneic CAR-Ts. According to Taapken, however, this may take some time. Furthermore, the currently used lentiviral gene vectors often integrate into highly expressed coding regions of the T cell genome boosting the risk for cancer. However, tech providers are already working for a solution.

The second field of particular interest for M&A, but also for niche player expertise, is gene therapy as shown by the recent Shire-Servier deal. The dynamic is also demonstrated by the fact that 50% of the eight currently approved gene therapies – Imlygiuc (Amgen), Strimvelis (GlaxoSmithKlaine) Invossa (TissueGene/Kolon Life Sciences/Mitsubishi Tanabe), and Luxturma (Spark Therapeutics) – have been authorised in the past two-and-a-half years. And more than 350 gene therapies are under preclinical and clinical development – the majority of them gene replacement approaches (59%); 10% onkolytic therapies; and 20% cell-based immune therapies. With the first generation of products on the market to guide the way, and supportive regulatory partners, the time is right for new chapters on cell and gene therapy.

Beiersdorf

Beiersdorf Brainomix

Brainomix BioNTech SE

BioNTech SE